hmrc pay tax bill

-- HMRC receives your payment within 3-4 business days Get started today Pay your invoices and bills by credit card. Payments can take between 1 to 5 working days to reach HMRC so if the payment deadline falls on a bank holiday or a weekend make sure that your payment reaches HMRC before that or youll be fined 100.

Pay Hmrc Kiqi Chartered Certified Accountants

In simple assessment an individual receives a calculation of tax to pay for the tax year by HMRC.

. If you want to pay HMRC by an online or telephone bank transfer you must make sure you send your money to the right place. People do not have to pay tax on an estate as. With Billhop you can pay your HMRC tax bill using personal or corporate credit cards from any card issuer.

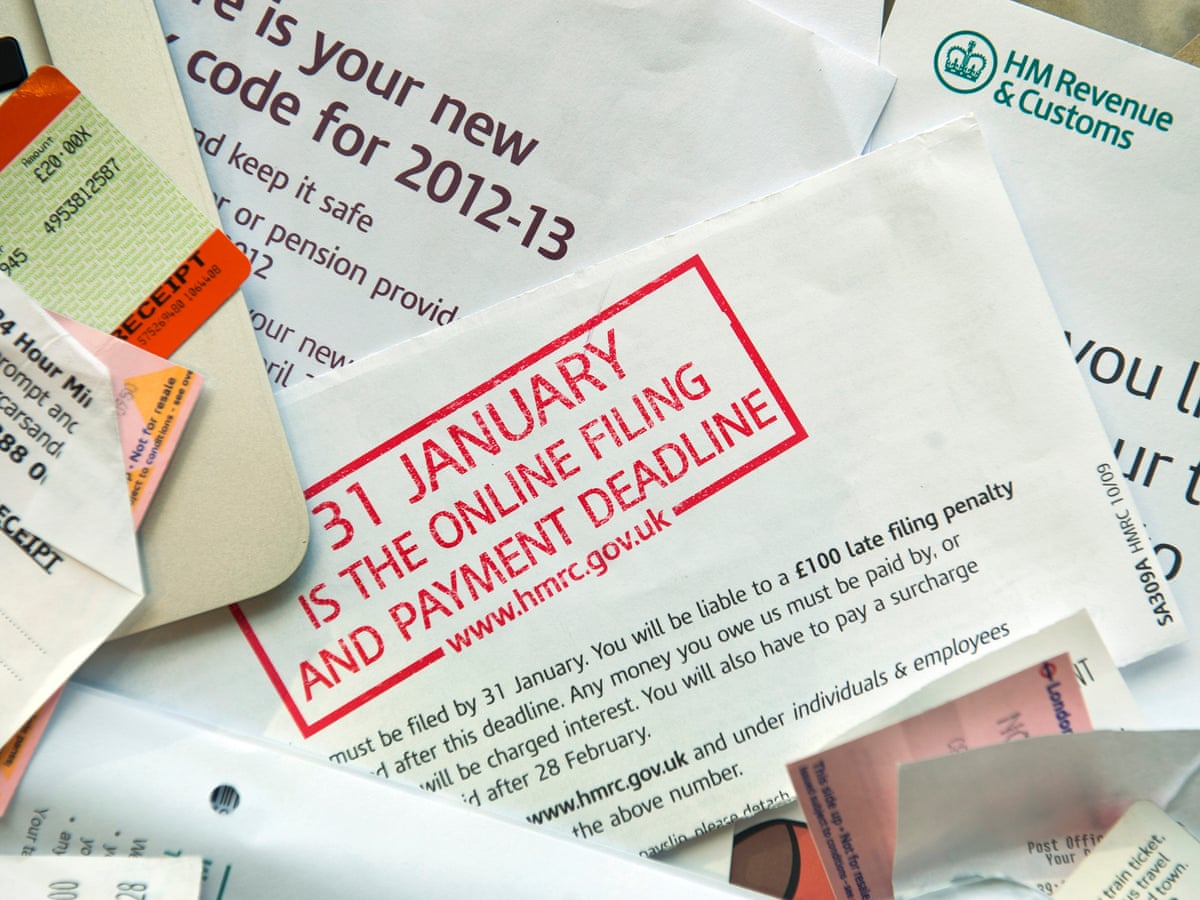

HMRC warned of risks it faces policing new pay. The due date for payment is likely to be either 31st January following the end of the tax year or three months after the date of the Self Assessment letter if it is later than 31st January. So if youre thinking I cant pay my tax bill dont ignore the situationIts best to get in touch with the tax authority to see if you can agree to an HMRC payment plan.

You can pay by cash or cheque made payable to HM Revenue and Customs only. Youll find the payment reference. Use Billhop to pay all forms of HMRC bills VAT Income tax Corporation tax Self assessment tax Stamp duty land tax Employers PAYE and National Insurance Why pay your tax with Billhop.

Given as a concession it is there to help individuals and businesses in repaying tax bills at an agreed monthly figure over. There are several different ways to pay your Self Assessment tax bill including. If youre self-employed HMRC may ask you to pay an estimated amount of tax in advance which is known as payments on account.

HMRC supports taxpayers who may need help with their tax liabilities and cannot pay in full. Some 46billion was paid to the Government between April and December 2021 in inheritance tax Her Majestys Revenue and Customs HMRC data shows. HMRC Time to Pay helpline If you need to speak to HMRC to set up a plan you can use the Self Assessment payment helpline.

The good news is that whilst HMRC will no longer take your personal credit card payment processors like Billhop act as an intermediary and can turn your card payment into a bank transfer. Make sure to contact HMRC. This page also lists the BIC and IBAN information to use if your account is overseas.

If you have received a paying-in slip from HMRC you can also choose to walk into a bank or a building society and make the payment. Ways to pay HMRC You can choose to pay your Self Assessment tax bill online or by telephone banking by debit or corporate card online not personal credit card or CHAPS. Taxes which can be paid using this service are o self assessment o employer PAYE and national insurance.

But youll find all the necessary HMRC bank details here. Essential cookies make this website workWed like set additional cookies understand how you use GOVUK remember your settings and improve government servicesWe also use cookies set other sites help deliver content from their. Setting up an online monthly payment plan self-serve Time to Pay paying by debit or corporate credit card paying at a bank or building society Customers should contact HMRC if they have concerns.

The taxman claims he should be classed an employee of the BBC and BT. Three simple steps to pay your tax by card Register a Billhop account -- Either as a business or a private individual Add your payment -- Use the regular HMRC sort code and account number together with your reference Done. Once you receive your corporation tax bill from HMRC there are various ways of paying it.

Your tax bill should tell you which account to pay into. Paying tax to HMRC 2 PAYING BY DEBIT OR CREDIT CARD Payment can be made by credit or debit card online see Pay your tax bill by debit or credit card. What if I cannot pay my tax bill on time.

The number is 0300 200 3822 and its open Monday to Friday 8am to 4pm. If you pay self-assessment taxes you may be wondering how you can settle your 31st July tax bill or for small companies your Q2 VAT bill and still earn miles or points. A Time to Pay Arrangement is a monthly re-payment arrangement with HMRC.

Note that payment by personal credit card has not been possible since January 2018. Ask about Time to Pay. Pay corporation tax online via CHAPS Clearing House Automated Payment System or Bacs Bankers automated clearing system Pay it over the phone using telephone banking Direct debit At your bank or building society.

If you cannot pay the tax you owe in full and on time HMRC can work with you to find a way for you to pay what you owe. Once they have filed their 2020 to 2021 tax. This involves making two payments one by 31 January and one by 31 July where you pay half of the estimated tax bill thats due by the following 31 January.

As quickly as possible in a. You should write your 14 or 15 character payment reference on the back of the cheque. Dec 13 2021 HMRC Time to Pay is a service you can use to pay a tax bill in instalments.

This is when workers who bill for their services via limited companies avoid paying income tax and national insurance. HMRC make it simple by calculating the tax to pay by taxpayer. Direct Debit online banking personal debit card corporate debit or credit card bank transfer using CHAPS Faster Payments or Bacs in-branch at your bank or building society by cheque through the post How long will it take your payment to reach HMRC.

Paying your tax bill If you agree with the assessment you must pay the due amount by the date given in the letter either online or by cheque payable to HMRC. If you cant pay a different type of tax look for contact details on any communication youve had from HMRC about the bill. The star is challenging the bill and says all tax was paid via a partnership.

An Easy Way to HMRC Simple Assessment and Payment of Tax Bill Self-assessment is a system by which HMRC collects the tax amount. Pay your Simple Assessment tax bill You must pay your Simple Assessment tax bill if youve been sent a letter by HM Revenue and Customs HMRC.

Tax Return United Kingdom Wikipedia

10 Ways To Cut Your Tax Bill Tax The Guardian

Contractors Can Pay 2019 20 Self Assessment Bills Over Time It Contracting

What To Do If You Ve Made A Mistake On Your Tax Return Mirror Online

Self Assessment Tax Return And Payments Inniaccounts

How To File Your Uk Taxes When You Live Abroad Expatica

Paying Hmrc Tax Bills Response From Hmrc In Reply To First Response

0 Response to "hmrc pay tax bill"

Post a Comment